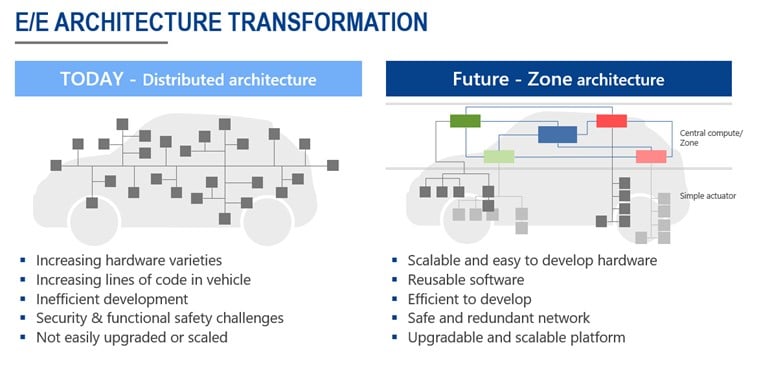

These days it can be observed in the press that automaker market value is defined by innovation and the pace of evolution from traditional vehicle design toward electrical, autonomous, connected vehicles, enabled by software built on service-oriented platforms. The high rate of innovation and aggressive business growth targets that characterize emerging high-tech automakers are rewarded with a higher valuation in capital markets versus traditional automotive OEMs that, by comparison, appear to lag in their efforts to transform product offerings. The goal is to make the jump from ordinary vehicles with progressively smarter features to the integrated, updateable concept of a smartphone on wheels. Established auto manufacturers face the challenge of changing existing E/E architectures from conventional, highly-distributed ECU systems toward more integrated Domain/Zone architectures.

Relative “newcomer” automakers such as TESLA reap the benefit of having no legacy in conventional ECU development, which has allowed these companies to develop vehicles with new domain- and zone-based E/E architectures from the very start.

With the advent of ever more powerful automotive-grade processors, multi-core microcontrollers, and the application of higher-bandwidth network technologies like Gigabit Ethernet, there are clear advantages to a more centralized computing approach for vehicle electronics. To stay competitive in the long term, traditional automakers must make fundamental changes to vehicle hardware and software designs and design processes. However, these companies face an additional challenge during this transition: vehicles based on older distributed computing architectures are still being churned out by the millions each year. Short-term competitiveness depends on pushing new features through this legacy pipeline with existing vehicle architectures, even while fundamental changes are being made to the development pipeline and electronic systems for the longer term.

Add to this the pressure that comes from ever-increasing CAFE (corporate average fuel economy) fuel economy standards that are accelerating the move to electric vehicle (EV) production. Automakers who do not keep up with the standards face CO2-certificate penalty payments that hurt profits and benefit newcomers who focus solely on EVs. This regulatory penalty system was set up to motivate the industry to pivot to the production of more climate-friendly vehicles in eleven US states and in the EU. Automakers who exceed these standards can sell these CO2-certificates to companies who do not yet meet the standards with the mix of vehicles they produce each year. For example, TESLA reaps a substantial benefit from this regulation in the form of additional income, paid by the traditional car makers – $1.6B in 2020.

Under these circumstances, the capital market determines the combined value of VW, DAIMLER, and BMW at €186B – much lower than the $570B valuation of TESLA alone. TESLA produced roughly 500k cars in 2020 and, not including the income from CO2-certificate payments, is not (yet) turning a profit on car production. Over the same period, these three German automakers produced roughly 14M vehicles and, even including outgoing penalty payments, showed operating profit for the year. New E/E architectures will be a major factor for the success of traditional car makers, allowing faster deployment of EV vehicles, faster time-to-market (TTM) for new software-based features, and even new revenue streams based on paid feature updates to existing vehicles over time (another TESLA innovation). In addition to the increased development efficiency it promises, it appears likely that such changes and their follow-on effects will also have a major impact on these companies in the stock market.

How can Renesas support these OEMs and related Tier 1 supplier companies to affect a faster transformation? How do we contribute to modern centralized E/E architectures inside the connected, autonomous, electrified car? And what is the expected impact of COVID-19 on the global Automotive megatrends and E/E architecture trends in the mid- and long-term? These questions lead us to re-visit the latest trends and review our semiconductor chip and software development strategies.

Our market understanding is that the megatrends stay the same: we continue to expect long-term, double-digit growth in the areas of connectivity, autonomy, and electrification.

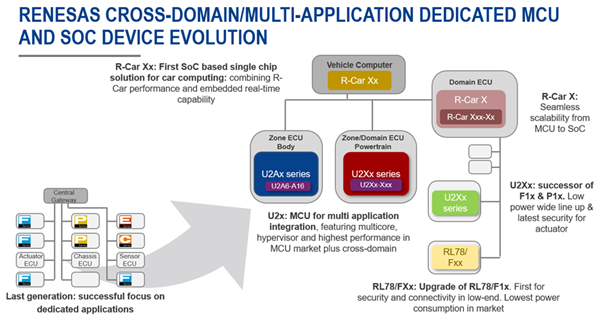

COVID-19 has changed perspectives on public transportation and “Shared” services, but it has not changed the fundamental automotive trends. On the one hand, you may expect that the pandemic will drive down demand for shared services and increase personal usage of vehicles in the future. On the other hand, a driverless taxi service is “shared” without requiring co-occupancy - it can be used by one household at a time without sharing the space with other passengers or even a driver. In the end, whether “shared” or “personal” (CASE or PACE), new E/E architectures and technical requirements do not change, and our roadmaps for semiconductor devices and software development are not affected. For example, requirements for Gigabit Ethernet/TSN, fulfillment of the latest Functional Safety and security features, and service-oriented architectures with a high degree of Freedom From Interference (FFI) remain. We are well positioned with our long-term commitment to the Automotive market, long-established Automotive customer collaboration efforts, and portfolio of cross-domain/multi-application MCU and SoC devices.

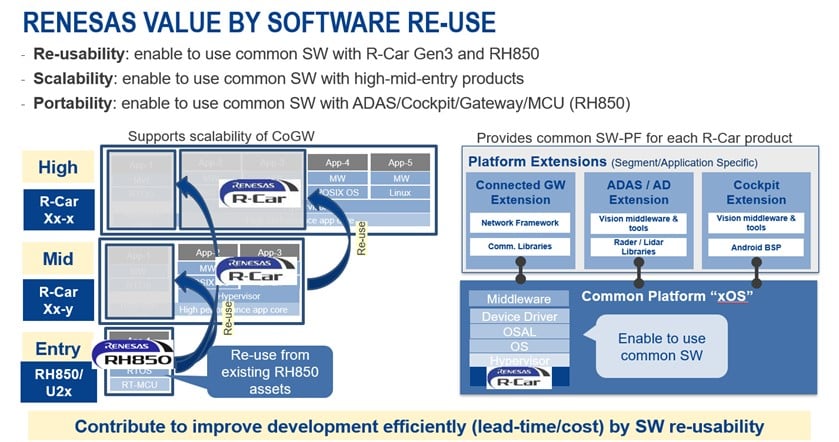

The Renesas approach creates value for our customers because our new products allow a high degree of software and hardware IP reusability from previous generations and a scalable device lineup from the low end to the high end for maximum flexibility within a development project. This creates a big carryover benefit, using already-developed AUTOSAR- and Linux-based software in new, BOM-optimized architectures through the reuse of the Renesas R-Car SoC and RH850 MCU devices. The usage of our chipsets over several device generations minimizes customers’ risk and effort in the development, yielding lower costs, shorter development time, and a better TTM for their products.

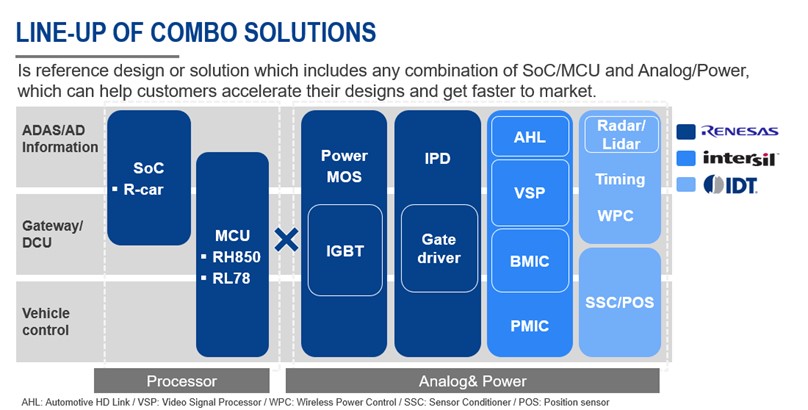

To complete the product line-up, recent M&A activities have expanded the product portfolio, allowing Renesas to offer complete chipset solutions including analog/power ICs for all Automotive application segments. This approach brings additional value and further reduces development efforts on the customer side. For example, Functional Safety (FuSa) requirements are more easily met by combining a tailored ASIL-D Power Management IC (PMIC) together with an ASIL-D capable R-Car SoC. This approach improves the system performance and FuSa capability of the entire system while optimizing power consumption and power management.

As important as the hardware is, software has become a dominating factor in the vehicle development process, both from the standpoint of overall cost and timing. Electrical architectures that centralize core vehicle feature processing and abstract the details are making software development more manageable and enabling a level of software reuse that was formerly unimaginable. Automakers and Automotive Tier 1 companies are making huge investments in reorganizing business units to reuse already-developed software and hardware from legacy platforms more efficiently. They are investing vast sums in the development of proprietary software platforms that give them a common execution environment that scales across application domains and is reusable across vehicle platforms. A company-proprietary “Vehicle OS” software platform on OEM side and efficient, cost-effective, agile, cross-segment development units on the Tier1 side will become the standard. Renesas supports these approaches with additional value: in addition to the R-Car Consortium, where an established ecosystem of 255 software and hardware partner companies is already available to provide standard and custom solutions, Renesas also provides a common, device-agnostic, OS-agnostic “xOS” software platform.

The xOS software platform for R-Car devices includes an OS abstraction layer (OSAL), OS- and device-independent HW abstraction layer (HAL) drivers, middleware services, and related software development tools. It allows our customers cross-segment, efficient, cost-effective reuse of software, and, finally, reduced TTM.

In summary, the rapid evolution of vehicle E/E architectures will have a great impact on consumers and a major impact on the health and capital market valuation of the automakers themselves. This is a tough challenge for the traditional industry players, who have legacy hardware and software assets to transform and integrate into new hardware and software systems. Renesas semiconductor solutions and software offerings support a reduction in TTM for our customers, and enable the efficient creation of secure, safe, environmentally friendly, connected mobility. This delivers value to all stakeholders, from vehicle customers to automakers and investors.

Please visit our website for more information about our chipset solutions and do not hesitate to contact us at any time.