There has been significant discussion around open radio access network in the past several years. According to Research and Markets [1], the open RAN market is expected to be more than 32B by 2030. Open RAN, in general, refers to an open radio access network with open standardized interfaces enabling operators to deploy RAN solutions based on multi-vendor interoperable products.

As opposed to traditional RAN, key concepts in open RAN initiatives are based around open network solutions enabled through RAN virtualization utilizing COTS hardware, AI-enabled RAN intelligence, standardized open interfaces, software, and API. Although radio access networks developed around these key concepts are expected to drive faster innovation while reducing CAPEX and OPEX for the operators, solution providers are challenged to meet network-level KPIs in an open RAN environment.

As the first generation of open RAN solutions moves from labs to deployment, challenges are mostly driven by the complexity of multi-vendor system integration. This is further complicated as the spectrum landscape evolves and the system providers need to select appropriate components with differentiating performance metrics to meet the overall system level KPIs the operators want to achieve. As the open RAN solutions progress through network-level deployment and upgrades, additional challenges are anticipated around the identification and resolution of network-level issues that may originate from various components, hardware, and software from diverse suppliers.

To date, there have been various industry initiatives around open RAN to address some of the challenges. O-RAN, an alliance established in 2018 through the ORAN forum and CRAN, is an industry-wide initiative represented by more than 340 companies, research, and academic institutes and has a commitment from 31 operators. The O-RAN alliance is driving various efforts, including the development of open RAN specifications and software, as well as supporting testing, integration, and demonstration of O-RAN implementations from different vendors. OpenRAN, another initiative led by the Telecom infra project, focuses on defining RAN solutions based on general-purpose vendor-neutral software, open interface, and hardware to accelerate innovation and RAN commercialization.

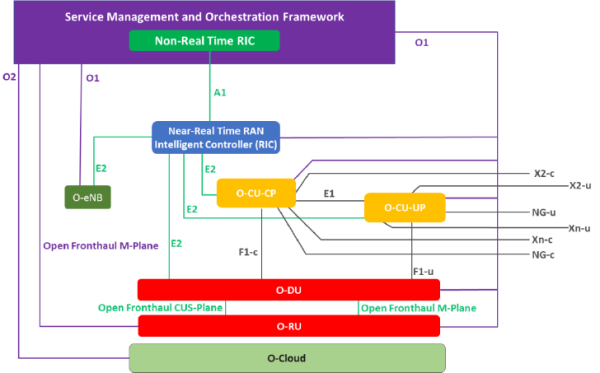

Renesas, as a world-leading semiconductor solution supplier to wireless RAN for more than a decade, appreciates the benefits as well as the challenges associated with the emerging RAN paradigm. Embracing the open RAN initiatives, Renesas has joined the movement through the O-RAN alliance to enable emerging and existing wireless RAN OEMs with innovative RF, timing, power management, optical, and low-power edge AI solutions. Staying in line with O-RAN architecture (Figure 1, [2]), Renesas has specifically created semiconductor solutions to reduce time-to-market while simplifying system-level integration challenges for the OEMs.

Figure 1. O-RAN High Level Architecture

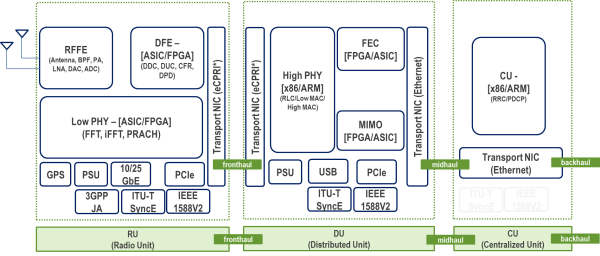

Figure 2 identifies key product categories relevant to open RAN from Renesas. As part of the overall portfolio, Renesas' innovative smart-RF and wireless modem solutions can provide a performance advantage for the OEMs targeting FR1 (in sub-6GHz), FR2 (in 24.25GHz – 31GHz), as well as the emerging 57GHz – 71GHz bands. Key differentiations are enabled through best-in-class linearity, higher output power, better noise figure, and power-optimized RF solutions based on a wide range of circuit level optimizations, antenna design, and module level reference designs. Based on these pre-verified designs, OEMs can create wide-ranging solutions targeting massive MIMO, Macro, and Small cell architectures for both mobile and fixed wireless open radio access networks.

Figure 2. Renesas Key Product Categories for Open RAN

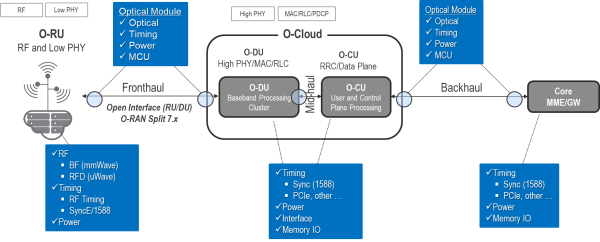

To enable system providers with interoperable radio and distributed/centralized units, Renesas timing solution supports a comprehensive portfolio that provides best-in-class phase noise and spurious performance on reference clocks for RF front-end and exceeds the timing and synchronization needs for fronthaul and backhaul transport of 5G O-RAN systems. These solutions support requirements related to various RU-DU-CU functional implementations, including the example shown in Figure 3, as defined by 7.2x for O-RAN.

Figure 3. Example O-RAN Functional Implementation.

Drawing on experience from low-power embedded computing, data center, and cloud-native servers, Renesas is also leveraging power management, memory, and optical interface solutions for the cloud-native open RAN systems.

For more information on Renesas solution related to wireless radio access network, visit Wireless Network | Renesas.

References

[1]: Open RAN Market Outlook (O-RAN) – An opportunity worth $32 Billion by 2030, Research and Markets Report, Jan. 2022.

[2]: O-RAN Use Cases and Deployment Scenarios – Towards Open and Smart RAN, O-RAN Alliance White Paper, Feb. 2020.