Renesas’ purpose, “To Make Our Lives Easier,” is driven by our commitment to aligning our business and sustainability goals and making positive changes for all stakeholders. To identify top strategic priorities, we conducted a materiality assessment engaging various stakeholders.

One of the materiality topics analyzed is our “response to climate change, energy and emissions.” We are committed to improving our response to climate change, energy and emissions by reducing the climate change impact on our business, conducting environment-friendly activities, and creating opportunities that contribute to the environmental protection.

Learn more about Materiality Assessment & Disclosure

Renesas has signed up to support the Task Force on Climate-related Financial Disclosure (TCFD) and joined the Japan-based TCFD Consortium (announced on April 15, 2021). As a way to demonstrate our support for TCFD recommendations, we have been examining the risks and opportunities that climate change poses to our business, and proactively disclosing information to stakeholders based on the TCFD framework, including “Governance,” “Strategy,” “Risk Management” and “Indicators and Targets.” We have also developed a business strategy that further takes climate change into consideration and made strategic decisions to reduce risks and maximize opportunities brought by climate change.

Governance

At Renesas, we recognize various opportunities and risks brought by climate change as important factors in business strategies. Thus, our CEO is responsible for all company-wide activities related to sustainability. Policies and important factors related to climate change, as well as risks and opportunities, are regularly discussed and reviewed by the CEO, an Executive Officer appointed by the CEO and the Sustainability Promotion Office, and are reported to the Board of Directors. In addition, under the CEO’s supervision, a corporate officer who manages Renesas’ group-wide environmental activities assesses, plans and establishes a system on a global basis.

Sustainability Promotion Structure

Environmental Management System

Strategy

Climate change is a critical issue for Renesas. To understand the impact of climate-related risks and opportunities on Renesas Group’s business, strategy and financial planning, and to establish countermeasures, we conducted a scenario-based analysis using the following assumptions.

Assumptions for Scenario Analysis

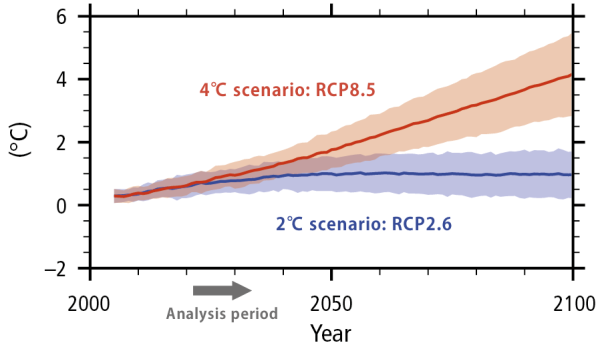

For the analysis, we took all regions into consideration and the scope of our greenhouse gas (GHG) emission range was verified by a third party (more than 95% of total GHG emissions). We selected all businesses segments for the scope, consolidated accounts for the company scope, and 2030 as the time axis. Scenarios included SDS (Sustainable Development Scenario) by the IEA (International Energy Agency), IPCC RCP2.6, etc. as "below 2°C scenario," and the IEA STEP (State Policies Scenario) as "4°C scenario,” and RCP8.5 by IPCC (Intergovernmental Panel on Climate Change).

| Item | Scope of analysis, time axis, and selected scenarios |

|---|---|

| Region | All Regions Scope of GHG emission verified by a third party (95% or more of total GHG emissions) |

| Business scope | Expected financial impact |

| Company scope | Scope of consolidated financial statements |

| Time axis | 2021 - 2030 |

| Scenario selection | Below 2℃ scenario: IEA SDS scenario (Sustainable Development Scenario), IPCC RCP2.6, etc. 4℃ scenario: IEA STEP (Stated Policies Scenario), IPCC RCP8.5, etc. |

How We Conducted Scenario Analysis

First, we predicted social and regulatory trends as of 2030 and listed a wide range of climate change-driven risk and opportunity items that are likely to impact the Group based on the, using risks and opportunities exemplified in the TCFD recommendations as the basis.

Risks can be broadly classified into transition risks related to the transition to a low-carbon economy and physical risks related to physical changes due to climate change. Transition risks include policies and laws, markets, reputations (e.g., changes in reputations by customers and investors), etc. Physical risks include those with chronic occurrences (e.g., average temperature increase, changes in precipitation and weather patterns, rising sea levels) and acute ones (e.g., intensification of extreme weather). Opportunities were categorized in terms of resource efficiency, products and services, and new markets.

Next, based on our mid to long-term business plan, we narrowed down on the items that are expected to have a significant impact on our operations due to climate change. For these items, we collected parameters based on the below 2°C scenario and the 4°C scenario and extracted data regarding potential financial impact in 2023. Based on the results, we considered countermeasures to increase organizational resilience.

Hypothetical Events in below 2°C and 4°C Scenarios

| Scenario | Hypothetical events |

|---|---|

| Below 2°C RCP2.6 |

|

| 4℃ RCP8.5 |

|

Reference: Global average temperature change forecast (Source: IPCC)

Summary of Extracted Results from Scenario-Based Analysis

Based on this analysis, the primary risks and opportunities for the Group and countermeasures are as follows. We anticipate a major opportunity in case of the below 2°C scenario in particular, and will proactively promote measures to seize that opportunity in the future.

Risks

- Due to the introduction of carbon pricing in countries we operate in, there are risks such as the cost increase for meeting requirements, cost increase of highly carbon-intensive raw materials, and production consignment fees.

- There is a risk of lost sales opportunities or decreased sales if development delays occur in markets or products that require energy conservation, or if customers' demands for decarbonization cannot be fully met.

- Increase in abnormal weather may affect manufacturing bases and distribution networks, leading to a decrease in sales and the risk of incurring recovery costs.

Opportunities

- Opportunities for a significant increase in demand for products and solutions that address decarbonization and low carbonization. Especially in the automotive business, the demand for related products is expected to grow as the EV market expands, and in the industrial business, the demand for low-carbon and decarbonized technologies (e.g., wind power, FA) is expected to grow.

- Opportunity to capture new markets by responding to changes in customer preferences and interests associated with climate change.

Countermeasures

- Respond to the risk of increasing carbon taxes by steadily implementing measures to achieve GHG emission reduction targets, establishing suppliers' GHG emissions, and promoting reduction measures.

- Enable timely market introduction by accelerating the start of development through advance detection of changes in energy-saving standards in each country and by introducing development methods that enable flexible function changes.

- Proactively disclose environmental information that promotes and accelerates environmental activities and communication in response to decarbonization efforts demanded by customers and investors.

- Accelerate the development of highly energy-efficient products, such as expanding the lineup of products and solutions, and acquiring next-generation technologies that realize high speed, high functionality, and high efficiency.

- Continue to invest in research and development to respond to new market expansion opportunities due to business diversification, changes in consumer preferences, etc.

Details of Analysis and Countermeasures

We assume when each risk and opportunity will materialize based on the scenario-based and other analysis, and disclose information over nine years from 2022 to 2030 by classifying them into “short-term,” “mid-term,” and “long-term.” We assume “short-term” to be within 3 years, “mid-term” over 3-6 years, and “long-term” over 6 years.

Financial Impact and Countermeasures for Risk Factors

| Category | Expected financial impact | Period | Countermeasures | |

|---|---|---|---|---|

| Transition risk | Strengthening of laws and regulations | Various laws and regulations will be strengthened toward decarbonization, and the cost to meet the needs will increase.

| Short to mid-term |

|

| Changes in technology and markets | Sales opportunities will be lost due to delays in development in markets and products that require energy conservation, and our profits will decrease. As an example, it is assumed that sales of MCUs for ICE will decrease due to the decrease in gasoline-powered vehicles. | Short to mid-term |

| |

| If the carbon tax imposed on our suppliers is reflected in the unit price of materials, we assume that production costs will increase. | Mid-term |

| ||

| Changes in stakeholder evaluation | Sales will decrease if we are unable to meet customer demands for decarbonization in the supply chain. In addition, the expansion of ESG investment is expected to affect fund procurement. | Mid-term |

| |

| Physical risks | Increase in disasters due to extreme weather | Due to an increase in disasters caused by abnormal weather, our own sites and supplier sites will be affected. Sales will decrease during the period until restoration, and restoration costs will be required. | Mid to long-term |

|

Financial Impact and Countermeasures for Opportunities

| Category | Expected financial impact | Period | Countermeasures | |

|---|---|---|---|---|

| Efficient use of resources | Efficient use of resources (energy, water) at business sites and production bases will be promoted and costs will be reduced. | Short-term |

| |

| Low carbon emission products and services | Expansion of xEV solution market | As decarbonization progresses in the automotive sector, the xEV solution market expands. | Short to mid-term |

|

| Expansion of industrial solutions market | Decarbonization will progress in the industrial sector, and the related industrial solutions market will expand. | Short to mid-term |

| |

| Respond to changes in customer preferences and interests | Increase sales by responding to changes in customer interest (energy efficiency, IoT, sensors, advanced weather forecasts, etc.) associated with climate change. | Short, mid to long-term |

| |

| New market expansion | New business | Diversion of technologies developed in existing businesses to new industries in a low-carbon society | Short to mid-term |

|

| Emerging markets | "Sales of IGBTs and millimeter-wave beamformer solutions for 5G to emerging countries will increase as the decarbonization needs increase. | Short to mid-term |

| |

Risk Management

We have established a company-wide risk management system based on the “Renesas Electronics Group Risk and Crisis Management Regulations.” We regularly maintain our risk management system for possible risks that may occur, and for each one, a department will be put in charge of crisis management depending on the type of risk to conduct the day-to-day risk management. We also attempt to identify risks in advance by checking those that are represented realistically in our Risk Map. At the same time, we formulate contingency measures, systems, and response policies to prevent and respond to those risks. Furthermore, in the event of a company-wide emergency, we would establish an Emergency Response Headquarters (ERHQ) led by our CEO, which is designed to gather information, propose countermeasures, and implement measures to minimize losses.

Learn more about Risk Management

Indicators and Targets

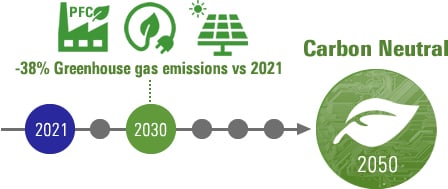

Renesas Aims to Become Carbon Neutral by 2050 to Minimize the Impact of Climate Change

As an interim target, we have set a goal for 2030 to reduce greenhouse gas (GHG) emissions by 38% compared to 2021 levels, which is in line with the 1.5°C target (an effort to limit the increase in global average temperature to 1.5°C compared to pre-industrial revolution levels). This target has been certified as a science-based target by the Science Based Targets initiative (SBTi) (announced on August 25, 2022).

We plan to achieve our goal by reducing the emission of PFC gas – a greenhouse gas that heavily impacts the environment – and meeting the domestic electrical and electronics industry targets in Japan and the energy intensity reduction target in accordance with the Energy Conservation Law. These initiatives also include expanding the use of reusable energy at our manufacturing sites which consume significant amounts of energy.

Regarding Scope 3, we have also set a new target for reducing GHG emissions by 2026 by suppliers (including outsourced production companies) who account for 70% of GHG emissions in Category 1 of Scope 3. We will strive to meet those targets and reduce GHG emissions throughout the supply chain.

Learn more about Key Environmental Priorities and Goals

Glossary

Assumptions for Scenario Analysis

| IEA | International Energy Agency |

| SDS | Sustainable Development Scenario |

| STEPS | Stated Policies Scenario |

| IPCC | Intergovernmental Panel on Climate Change |

| RCP | Representative Concentration Pathways |

Financial Impact and Countermeasures for Risk Factors

| Scope 1 | Scope 1 emissions refer to direct greenhouse gas (GHG) emissions that occur from sources that are controlled or owned by an organization. This includes all land-use emissions from companies that own or control land to produce agricultural and forest-risk commodities. |

| Scope 2 | Scope 2 emissions refer to indirect GHG emissions associated with any purchases of electricity, steam, heat, or cooling. |

| Scope 3 | Scope 3 emissions are the result of activities from assets not owned or controlled by the reporting organization, but that the organization indirectly impacts in its value chain. |

| PFC | Perfluorocarbon. A type of the alternative CFC Gas used for etching and cleaning in the manufacturing process of semiconductor manufacturing. |

| 3R | Reduce, Reuse, Recycle. Acronym for three initiatives to reduce waste. |

| ICE | Internal Combustion Engine |

| MCU | Micro Control Unit |

| xEV | The generic name for electromotive vehicles such as a hybrid electric vehicles, plug-in hybrid electric vehicles and fuel-cell electric vehicles |

| ADAS | Advanced Driver-Assistance Systems |

| BCM | Business Continuity Management |

Financial Impact and Countermeasures for Opportunities

| PPA | Power Purchase Agreement: A solar PPA, or power purchase agreement, is typically an off-balance sheet financial arrangement through which an energy consumer allows a third-party developer to develop, construct, operate and maintain a photovoltaic (PV) system on its property, at no cost. The energy consumer then agrees to purchase electricity from the system’s owner, over a predetermined period. |

| BMS | Battery Management System |

| Monolithic | Reconstruction of multiple ICs (Die) separated by function and integration into one Die for implementation. |

| Wireless | Implement the Wireless (wireless communication) function. |

| OTA | Over The Air: Sending and receiving data via wireless communication |

| DDR | Double-Data-Rate: Advanced version of SDRAM, a type of memory IC. |

| Millimeter-wave beamformer solutions for 5G | Learn more |

| FA | Factory Automation |

| Endpoint AI | Learn more |

| BA | Building Automation |

| RF | Radio Frequency |

| IGBT | Insulated Gate Bipolar Transistor |

| IIOT | Industrial Internet of Things |

<Indicators and Targets>

| Scope 3 Category 1 | Includes GHG emissions from all purchased goods and services |