Governance

Governance | Risk Management | Ethics and Compliance | Information Security | Executive Compensation | Tax Policy

Governance

Renesas Electronics Corporation is registered in Tokyo, Japan and is listed on the Tokyo Stock Exchange. We currently operate from headquarters located in Toyosu, Tokyo as well as through sales offices and companies, manufacturing and design, and development sites located around the world in Asia, Europe and the Americas. Each office is organized and operated in accordance with the laws and regulations of the countries.

Corporate Governance Policy

Based on our “Purpose”: “To Make Our Lives Easier”, we are committed to develop a safer, healthier, greener, and smarter world by providing intelligence to our four focus growth segments: Automotive, Industrial, Infrastructure, and IoT. To achieve our Purpose, we aim to respond flexibly to change, solve issues, and continue to create value in a sustainable way based on the “Renesas Culture”, a guideline of conduct for all of our activities, behavior and decision-making, which consists of five elements. Based on Renesas Culture, we aim for continuous growth and enhancement of corporate value over the mid- to long-term. In addition, we aim to co-exist and co-prosper with every stakeholder in order to create long-term sustainable value as a responsible global company. In order to achieve this, we must thrive in the rapidly-changing, competitive global semiconductor marketplace, and continue to satisfy the expectations of all of our stakeholders and to grow with profit expansions. We will continue to solidify our business foundation as a global semiconductor company by honing technological advancement as well as supplying excellent semiconductor products and optimized solutions through elaborate marketing and sales activities. We recognize the importance to build a corporate governance structure and system that enables transparent, fair, quick and resolute decision-making. We will continue to enhance our corporate governance structure and system through various measures such as communication and cooperation with our stakeholders including shareholders, appropriate information disclosure, ensuring appropriate delegation of authority and highly effective oversight functions.

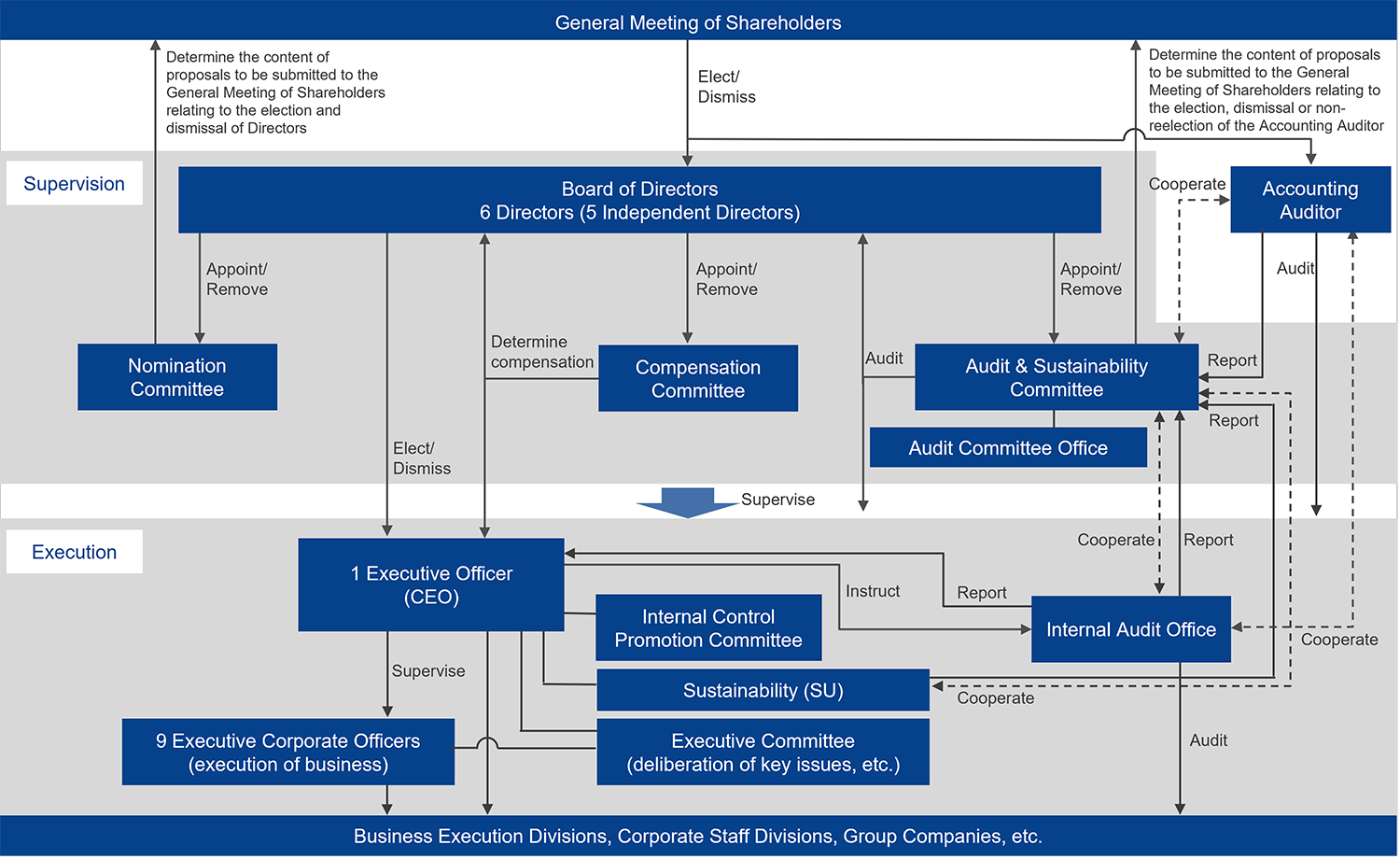

To execute corporate governance and remain as a sustainable and responsible partner for our stakeholders, we are committed to maintaining a corporate governance structure that is transparent, enabling fair, fast and resolute decision-making and robust accountability. We do this by implementing our policies through our processes and systems, from supervision of our business operations to business executions. Our ultimate objective is to achieve sustainable enhancement of corporate value over the mid- to long-term for the benefit of all the stakeholders.

As required under the Companies Act in Japan, we have established an internal control system to ensure our corporate officers, and employees comply with the applicable laws, regulations and our articles of incorporation. In addition, we periodically hold Internal Control Promotion Committee to discuss our Group's policies and the state of compliance with respect to internal control.

Our corporate governance policies and practices are outlined in our Corporate Governance Report, Corporate Governance Guidelines and Basic Policy on Establishment of Internal Control Systems.

| Title | Format |

|---|---|

| Corporate Governance Report | |

| Basic Policy on Establishment of Internal Control Systems | |

| Articles of Incorporation of Renesas Electronics Corporation | |

| Corporate Governance Guidelines |

Renesas Corporate Governance Structure

We recognize the importance of operating business efficiently and ensuring the soundness and transparency of management in order to continuously increase and develop corporate value. We are working to implement various measures to enhance corporate governance and improve our management system that makes us able to deal with the rapidly-changing business environment. As part of those measures, we have adopted a governance structure with 3 committees called the Nomination Committee, Compensation Committee, and Audit Committee, all of which are comprised of a majority of outside Directors, under the Companies Act in Japan from 2024. In this structure called “Company with Nomination Committee, etc.”, the Board of Directors focuses on addressing important management issues and overseeing (monitoring) the execution of our business by executive officers (including the Chief Executive Officer and other representative executive officers) (“Executive Officers” or “shikko-yaku” in the Japanese Companies Act). In addition, to execute corporate governance, we regularly hold the Internal Control Promotion Committee and the Executive Committee. From the sustainability perspective, we have given the Audit Committee responsibility and authority to oversee our sustainability-related activities led by Sustainability (SU) and are making efforts to integrate sustainability-related initiatives into our corporate governance. In line with this, our company will refer to the statutory committee of “Audit Committee” as “Audit and Sustainability Committee”.

Directors and Board of Directors

Each Director serves a term of one year. To ensure supervisory responsibility for management is clear, the Company asks its shareholders to elect or reelect the Directors at the General Meeting of Shareholders every year.

Our Board of Directors is organized in accordance with the Companies Act in Japan. As of March 2025, the Board of Directors is comprised of 6 members including 5 outside Directors, each elected at our General Meeting of Shareholders. In principle, our Board of Directors meets regularly once every 3 months, and extraordinary meetings are held as necessary to supervise the execution of duties by Directors and Executive Officers as well as to perform a decision-making function with regard to important management issues. Board responsibilities and expectations are identified in the Renesas Board Charter that is approved by the Board of Directors.

Check Corporate Governance Report for the evaluation on the effectiveness of Board of Directors.

The functions and roles of the 5 outside Directors out of 6 Directors are to participate in management decision-making and to oversee or check the execution of duties by other Directors and Executive Officers from various outside perspectives by drawing on their knowledge, experience, and insight gained from their own careers. We appoint a Lead Independent Director from among outside Directors.

The composition of our Board of Directors and skill matrix of each Director are shown in the table below.

| Name Title | Executive Leadership | International Business | Semiconductor / Technology Industry | Software / Digital | Sustainability / ESG | Finance | Risk Management / Legal Affairs | Public Board Experience |

|---|---|---|---|---|---|---|---|---|

| Hidetoshi Shibata Director | ● | ● | ● | ● | ||||

| Jiro Iwasaki Lead Independent Director | ● | ● | ● | ● | ● | |||

| Selena Loh Lacroix Independent Director | ● | ● | ● | ● | ● | |||

| Noboru Yamamoto Independent Director | ● | ● | ● | ● | ● | ● | ||

| Takuya Hirano Independent Director | ● | ● | ● | ● | ||||

| Tomoko Mizuno Independent Director | ● | ● | ● |

Independent Directors

To ensure that the corporate governance of Renesas is conducted with the appropriate level of objectivity and transparency, the Company has established a standard for determining whether outside Directors are sufficiently independent; i.e., there is no possibility for a conflict of interest with the Company.

Therefore, only those individuals who meet the requirements of the Japanese Companies Act and the independence criteria set forth by the Tokyo Stock Exchange, and who do not fall within any of the categories described below are deemed to have sufficient independence to serve as outside Directors of the Company.

| Category | Item | Criteria |

|---|---|---|

| Business Relationship | Important Customer of the Company | Sales to such customer (on a consolidated basis) exceeds 2%* of the Company's consolidated revenue, or a direct or indirect user or purchaser of the Company's products who is deemed to have a similar level of importance. *Averaged over the past 3 years |

| Business Partner of which the Company is an Important Customer | Revenue from the Company (on a consolidated basis) exceeds 2%* of the business partner's consolidated revenue. *Averaged over the past 3 years | |

| Important Fund Provider | Funds provided exceeds 2% of the Company's consolidated total assets *As of the end of the last fiscal year | |

| Professional Services | Providers of professional services* (remuneration (on a consolidated basis) exceeds 2%** of the organization's consolidated revenue, or in the case of an individual, 10 million yen**) *Including accounting, legal, and consulting services **Average percentage and amount over the past 3 years | |

| Capital Relationship | Major Shareholders | 10% or more |

| Investees | 10% or more | |

| Others | Employees | The Company and its subsidiaries |

| Accounting Auditor | Accounting Auditor of the Company *Within the last 3 years | |

| Recipient of Donations | More than 10 million yen *In any of the past 3 years | |

| Family Relationship | Spouse, close relative up to the second degree of kinship, or person living together of a person* who manages the management of the Company or its affiliated companies *Senior Vice President and above |

The details of our Independence Standard of Outside Directors

All of our outside Directors (5 Directors) are designated and noticed to Tokyo Stock Exchange as Independent Directors. Independent Directors are outside directors who do not have any conflict in interest with the Company, the Company’s major shareholders or their mother company.

Renesas’ Independent Officer Notification Form (Submitted on February 28, 2025 – a translated version of the document submitted to the Tokyo Stock Exchange)

Learn more about the overview of Renesas’ leadership team and their biographies

Three Committees

We have adopted a governance structure of “Company with Nomination Committee, etc.” and have established the Nomination Committee, Compensation Committee, and Audit and Sustainability Committee, which are comprised of Directors.

Nomination Committee

The Nomination Committee is comprised of 3 members, all of whom are independent outside Directors and the chairperson is the Lead Independent Director as of March 2025. The Nomination Committee will determine or deliberate on matters related to human resources such as (i) the content of proposals to be submitted to the general meetings of shareholders relating to the election and dismissal of Directors, (ii) the election or dismissal of Executive Officers, and (iii) CEO succession plan as well as matters prescribed by applicable laws and regulations and the Articles of Incorporation. In 2024, after the change of corporate governance structure, 4 Nomination Committee meetings were held, and all members of the committee were in attendance at all 4 meetings.

Board Diversity Policy

When deliberating items such as election and dismissal of Directors, the Nomination Committee considers the following points:

- The expertise and the experience of the candidate as well as the gender, age, ethnicity, and cultural background

- More than half of the members of the Board of Directors to be outside directors

- A Director who concurrently serves as an Executive Officer must not serve on public companies’ Boards other than Renesas, and outside Directors must not serve on more than 5 public companies’ Boards (including Renesas)

Compensation Committee

As of March 2025, the Compensation Committee is comprised of 4 members (including 3 independent outside Directors and 1 Director) and the chairperson is an outside Director. The Compensation Committee will determine or deliberate on matters related to compensation such as (i) the Company’s policy for determining compensation of individual Directors, Executive Officers, and Executive Corporate Officers (ii) contents of individual compensation based on such policy, as well as matters prescribed by applicable laws and regulations and the Articles of Incorporation. In 2024, after the change of corporate governance structure, 4 Compensation Committee meetings were held. All members of the committee were in attendance at all 4 meetings.

Audit and Sustainability Committee

The Audit and Sustainability Committee is comprised of 3 members, all of whom including the chairperson are independent outside Directors as of March 2025. The Audit and Sustainability Committee will (i) audit the performance by Directors and Executive Officers of their respective responsibilities and duties, (ii) prepare audit reports, (iii) determine the content of proposals to be submitted to the general meetings of shareholders relating to the election, dismissal and non-reelection of the Accounting Auditor, and (iv) oversee our Group’s initiatives on sustainability-related matters including sustainability-related policies, risk management, and compliance, as well as conduct matters prescribed by applicable laws and regulations and the Articles of Incorporation. In 2024, after the change of corporate governance structure, 6 Audit and Sustainability Committee meetings were held. 2 members of the committee were in attendance at all 6 meetings and 1 member of the committee were in attendance at 5 meetings.

The composition of each committee is shown in the table below.

◎: Chairperson, ○: Member

| Name | Title | Nomination Committee | Compensation Committee | Audit and Sustainability Committee |

|---|---|---|---|---|

| Hidetoshi Shibata | Director | ○ | ||

| Jiro Iwasaki | Lead Independent Director | ◎ | ○ | |

| Selena Loh Lacroix | Independent Director | ○ | ◎ | |

| Noboru Yamamoto | Independent Director | ○ | ○ | |

| Takuya Hirano | Independent Director | ○ | ||

| Tomoko Mizuno | Independent Director | ○ | ◎ |

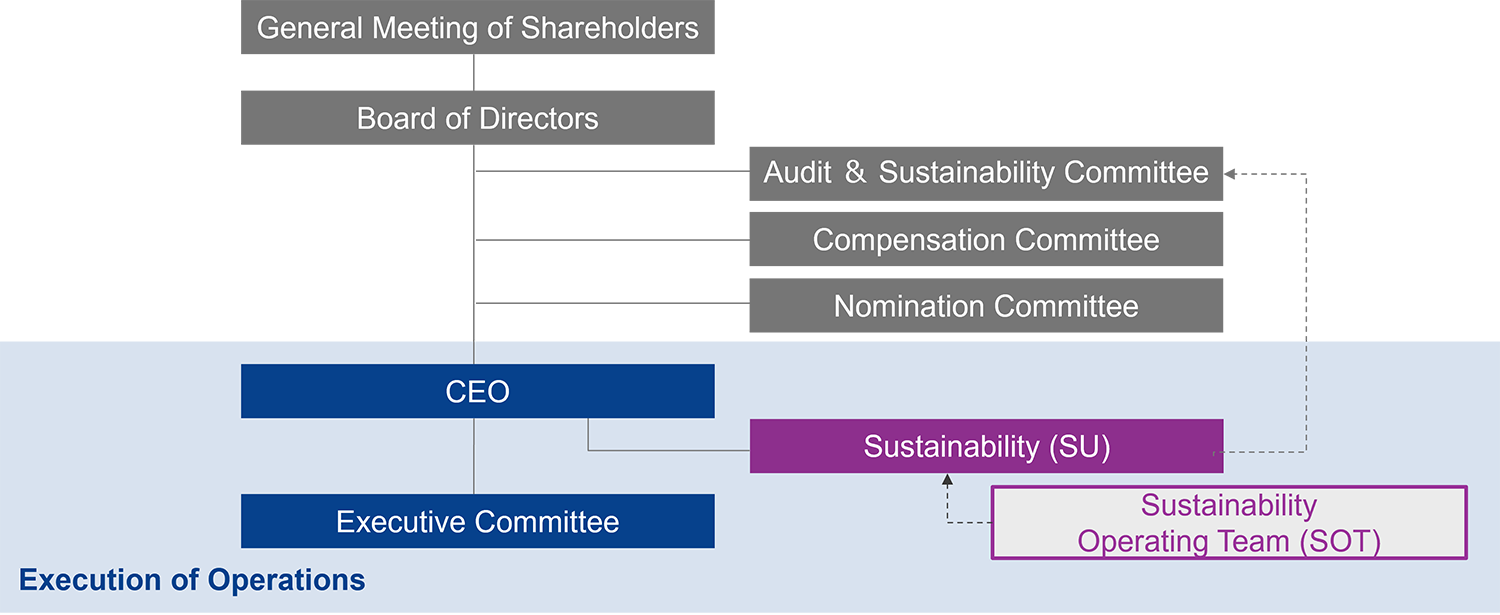

Sustainability Governance Structure

Renesas’ sustainability governance is led by the Sustainability (SU), which plays a central role in coordinating company-wide initiatives and embedding sustainability into our operations. Supported by the cross-functional Sustainability Operating Team (SOT), SU fosters collaboration and ensures the integration and implementation of ESG initiatives across the organization. The CEO holds overall responsibility for Renesas’ sustainability activities, ensuring strategic alignment with our business objectives. To maintain transparency and accountability, SU regularly reports on sustainability-related activities and progress to the Audit & Sustainability Committee and the Board of Directors.

Contributing to SDGs

Renesas’ efforts in Governance contribute to these Sustainable Development Goals targets:

SDG 16.5 Substantially reduce corruption and bribery in all their forms

SDG 16.7 Ensure responsive, inclusive, participatory and representative decision-making at all levels